NEW YORK (CNNMoney) -- Slower health care spending has helped buy Medicare more time before it will no longer be able to pay out 100 percent of benefits. But the program is still facing significant funding shortfalls.

NEW YORK (CNNMoney) -- Slower health care spending has helped buy Medicare more time before it will no longer be able to pay out 100 percent of benefits. But the program is still facing significant funding shortfalls.

A report released Friday by the trustees of Medicare and Social Security projects the magnitude of those shortfalls over the near- and long-term.

Medicare Part A, which covers hospital costs for seniors, is financed primarily by payroll taxes paid by workers. But since 2008 those revenues haven't kept pace with the program's costs. The federal government has made up the difference by both paying interest on assets in the Medicare trust fund and redeeming the assets themselves.

But that Medicare trust fund will be exhausted by 2026, the trustees estimated. Last year, the report put the date of insolvency at 2024.

"The Medicare report demonstrates, once again, the importance of the Affordable Care Act, which has strengthened Medicare's finances by reining in health care costs," said Treasury Secretary Jacob Lew.

Economists looking at the slowdown in health spending growth say it's still unclear how much of the slowdown is due to the implementation of health reform and how much is attributable to the slow economy of the past few years.

Robert Reischauer, one of the two public trustees of Medicare and Social Security, said it would be "a mistake" to interpret the two-year extension of solvency in the Medicare trust fund as "significant."

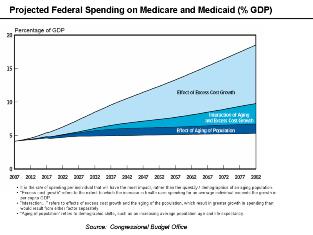

Medicare projections involve a great deal of uncertainty, because several factors can influence future spending patterns, Reischauer said. Among them: congressional legislation, new medical technologies and developments in the private health sector and the insurance market.

If nothing is done, the revenue coming into Medicare Part A will be able to cover just 87 percent of expected costs in 2033. By 2050 and beyond, it will only cover 70 percent, the trustees estimate.

Medicare Part B, which covers doctor visits, and Medicare Part D, which covers prescription drug costs, are financed primarily through premiums paid by seniors and by general federal revenue. Neither has a trust fund.

As program costs have risen, however, premiums have covered a smaller share. Consequently, general revenue today covers roughly 75 percent of Part B costs. Going forward, the cost of Part B is projected to rise from 2 percent of GDP last year to 3.3 percent by 2035.

In terms of Social Security, the trustees estimate the trust fund exhaustion date will be 2033, the same as their estimate last year. At that point the program will be able to pay three-quarters of promised benefits through 2087.

- Home

- News

- Opinion

- Entertainment

- Classified

- About Us

MLK Breakfast

MLK Breakfast- Community

- Foundation

- Obituaries

- Donate

11-08-2024 5:38 pm • PDX and SEA Weather